Our course on Double Bollinger Bands (DBB’s) is divided into several lessons. DBBs are a powerful variation on the standard single Bollinger Band, because they can tell us much more about momentum and therefore trend strength, both in flat and strongly trending markets.

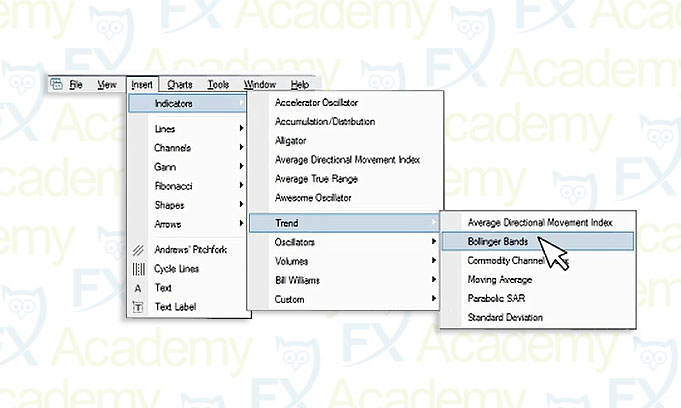

Double Bollinger Bands are 2 sets of BBs, using default settings set at the usual 2 standard deviation distance above and below the 20 period simple moving average line in the middle, as well as a second set of BBs plotted just 1 standard deviation above and below that central moving average.

Traders can, and do, tinker with the type and duration of the moving average and the number of standard deviations.

The two sets of Bollinger bands create three zones and we will talk about each zone and what they mean relevant to the position of the price movements. We will explain the 4 rules associated with these zones, and how to follow them in order to trade profitably.

In a previous lesson, we learned about Bollinger Bands as an indicator that can be useful in flat or gently trending markets, but not during strong trends. Now we will learn about Double Bollinger Bands (DBBs).

Double Bollinger Bands are a powerful variation on the standard single Bollinger Band, because they tell us much more about momentum and hence trend strength, both in flat and strongly trending markets.

This lesson will show that unlike standard Bollinger Bands, Double Bollinger Bands are exceptionally useful in strongly trending markets, because they help us to better determine the true momentum shown within the candlestick price action.

Start this Lesson ›

As we have already shown, two sets of Double Bollinger Bands create three zones: a sell zone, a buy zone, and a neutral zone. In this lesson, we will show how prices move within these zones and what these moves can mean for the trader.

When using the Double Bollinger Bands indicator, it is essential that you follow the 3 rules outlined in this lesson.

Start this Lesson ›

In this lesson we give a detailed explanation on the rules required as a basis for utilizing the Double Bollinger Bands trading with Bollinger Bands and candlesticks strategy successfully. We will show how to apply rules #1 & #2 to the 3 zone concept we learned previously.

Start this Lesson ›

In this lesson we outline the 3rd rule of the Double Bollinger Bands trading strategy. When the price action has started to settle within the neutral zone , that’s a signal to exit any trades that are riding the current up or down trend, because that trend is now showing weakness.

There isn’t enough up or down momentum for us to have confidence in the uptrend or downtrend continuing, so it is time here to think about getting out and perhaps utilizing a range-based trading strategy instead.

Start this Lesson ›

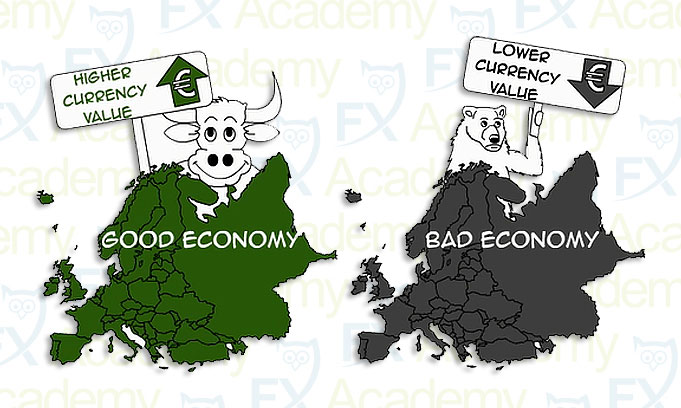

This lesson reviews Rule 4 of the DBB trading strategy rules. Rule 4 attempts to cut the risk of buying at the top or selling at the bottom that comes with chasing a strong trend that has already made significant progress and may be approaching major resistance or (if it has broken past historic highs or lows) exhaustion.

This rule is not easy to implement. Your success depends on how well you read and interpret the other technical and fundamental evidence, therefore we will talk about how to distinguish a bargain from a “falling knife” (i.e. an apparent bargain that continues moving against you after your trade entry, resulting in a loss).

Start this Lesson ›

We hope you found our site useful and we look forward to helping you again soon!